Great economic recession is in store for USA

Stock markets around the world plummeted yesterday in a wave of selling set off by a plunge in China that was reinforced by worries of weakening economies. The falling prices continued in early Asian trading today, but by midday the Chinese market seemed to be stabilizing.

While China was the first market to tumble, it was not clear what set off the selling. But once it began, it spread first to other Asian countries, then to Europe and the United States.

“It was sort of one of those days where somebody snaps their fingers, and the market’s hypnotic trance is over,” said Stuart Hoffman, chief economist of PNC Financial.

In China, where the stock market had been soaring, the government had warned banks about improper loans to finance stock speculation.

In America, the selling seemed to add to worries that a decline in the housing market, and problems in particular with loans to risky borrowers, could spill over. And a report yesterday indicating that orders for durable goods — items like washing machines and computers — were surprisingly weak in January revived doubts about the strength of the American economy, the New York Times reports.

After Wall Street saw its biggest losses on Tuesday since the Sept. 11, 2001, terrorist attacks, investors will be looking at fresh economic data on Wednesday to see if the plunge was justified.

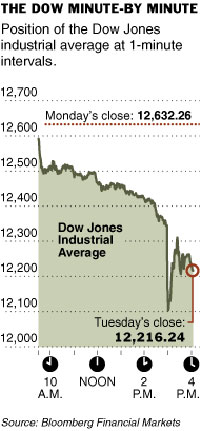

Investors drove the Dow Jones industrials down more than 400 points Tuesday as worries grew that U.S. and Chinese economic growth could hit obstacles, and on the feeling that share prices had soared too high too quickly.

The U.S. government's report Wednesday on gross domestic product could either assuage or aggravate those fears _ the market is expecting that the Commerce Department will say that GDP grew 2.3 percent in the fourth quarter, less than the initial estimate of 3.5 percent.

Also Wednesday, investors expect new data from the Commerce Department to indicate new home sales declined last month, and the latest survey from the Chicago Fed on regional manufacturing will register a reading of 50.0 for February, up from 48.8 in January.

The Chicago Fed report could give the market clues to how well the Institute for Supply Management's index of manufacturing activity for February will perform. The market is currently predicting that index to come in Thursday at 50.0, up from 49.3 last month. A reading above 50 indicates expansion, and below 50 indicates contraction.

Wall Street could again take cues from overseas trading. A 9 percent drop in Chinese stocks triggered Tuesday's steep fall in the U.S., which followed a long period of stable and steadily rising stock markets that had not seen such a volatile day of trading in several years.

The Dow's decline accelerated throughout Tuesday, and stocks saw a huge dip in late afternoon trading as computer-driven sell programs kicked in, and also as a computer glitch caused a delay in the recording of a large number of trades.

The Dow fell 546.20, or 4.3 percent, to 12,086.06 before recovering some ground in the last hour of trading to close down 416.02, or 3.29 percent, at 12,216.24, leaving it in negative territory for the year. Because the worst of the plunge took place after 2:30 p.m., the New York Stock Exchange's trading limits, designed to halt such precipitous moves, were not activated.

It was the Dow's worst point decline since Sept. 17, 2001, the first trading day after the terror attacks, when the blue chips fell 684.81, or 7.13 percent. In percentage terms, it was the biggest decline since March 24, 2003, when the index fell 3.6 percent as investors started getting rattled as U.S. casualties mounted in the early days after the invasion of Iraq.

The Nasdaq composite index fell 96.66, or 3.86 percent, to 2,407.86. The Standard & Poor's 500 index fell 50.33, or 3.47 percent, to 1,399.04, the AP reports.

Former U.S. Federal Reserve Chairman Alan Greenspan warned Monday that the American economy might slip into recession by year‘s end.

"When you get this far away from a recession invariably forces build up for the next recession, and indeed we are beginning to see that sign," Greenspan said via satellite link to a business conference in Hong Kong. "For example in the U.S., profit margins ... have begun to stabilize, which is an early sign we are in the later stages of a cycle."

Greenspan said that while it would be "very precarious" to try to forecast that far into the future, he could not rule out the possibility of a recession late this year.

Greenspan also warned that the U.S. budget deficit, which for 2006 fell to $247.7 billion, the lowest in four years, remains a concern.

Greenspan also said he has seen no economic spillover effects from the slowdown in the U.S. housing market, localnewsleader.com reports.

Source: agencies

Prepared by Alexander Timoshik

Pravda.ru

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!