Skeletons of Yukos. Why GML paid Alexey Golubovich $44 million. Part 2

Continued. Read Part I of the article here.

Alexey Golubovich, Yukos's former director for strategic planning and corporate finance was one of the main witnesses in the case against Yukos. How can one determine the basis of his testimony? Was it a wish to help the Russian justice system or the subtle game of a "double agent"?

In order to understand this, one may need to recall a few facts from his business biography. In the first part of our investigation, we talked about Alexey Golubovich's business projects and lawsuits in 2010–2022, in which one could see both the shadows of his former Yukos colleagues (for example, Mikhail Khodorkovsky, Yuri Beilin) and the non-systemic opposition.

His divorce proceedings with Olga Mirimskaya, which Golubovich is conducting in two jurisdictions - in Moscow and London - are closely connected with the past of Yukos. This week, the Moscow City Court will consider the appeal filed by Olga Mirimskaya against the decision to pay Golubovich $35 million as part of the property division claim. The claim concerns funds that had been allegedly received for Yukos shares. At the same time, his ex-wife has been in a pre-trial detention center since December 17, 2021, as part of a bribery case. According to Mirimskaya's lawyers, this criminal case has been dragging on since 2017. Moreover, it was her ex-husband, who initiated her arrest.

One does not need a psychologist to look into the details of this family case. One only needs to dust off the Yukos file and start almost from the very beginning.

From Menatep to Yukos

Alexey Golubovich was one of the seven main shareholders of Yukos. He was the chief architect of the oil company's financial schemes. On one of the counts, Yukos was charged with hiding its companies' revenues from tax authorities so that the revenues could be wired abroad. The amount of damage in one of the cases is estimated at $283 million. During the Yukos trial, Golubovich spoke in his interviews with various media outlets about his decision to leave the company to engage in investment business in 2001 - long before Yukos started experiencing problems in Russia. However, available facts show he remained very involved. Alexey Golubovich, according to his assistant, Elena Popova-Collongues, a French citizen, began his cooperation with Mikhail Khodorkovsky back in the 1980s. In an interview in 2003, Popova-Collongues stated:

"He said that he started Menatep with Khodorkovsky in 1989."

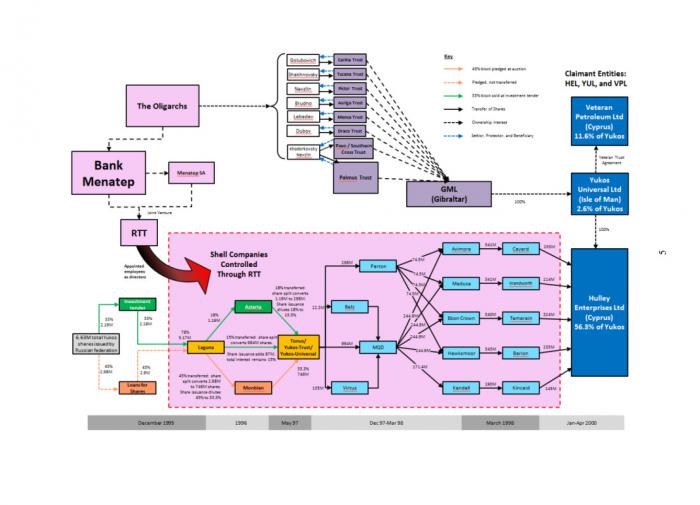

She admitted that on behalf of Golubovich, she founded 30 shell companies and registered them in offshore jurisdictions. Golubovich subsequently laundered about $600 million for Menatep with the help of those companies. He later denied these allegations.

“This wide network of umbrella companies was supposed to help the Russian oil kings expand their empire without violating the antitrust law that the companies listed on the Moscow stock exchange were subject to,” Popova-Collongues told Paris Match. “This structure was also created to carry out all sorts of acrobatic financial tricks, such as "dissolving" small shareholders whose assets were difficult to manage on the Moscow exchange, or hiding huge amounts from taxation. That was Dallas in Moscow. The company, the pseudonym of which was my name, worked for everyone and for no one at the same time."

In 2001-2007, Alexey Golubovich managed the Russian Investors Group, which the Kommersant referred as a group "close to Yukos." Golubovich would always distance Russian Investors from the oil company, but even in the case of Yukos v. Russia there is evidence establishing the true nature of Golubovich's investment company in the 2000s:

"Another offshore company - Wilk Enterprises Limited of Cyprus - was part of a group known as the Russian Investors Group. Wilk Enterprises was owned by Cypriot company Sequential Holdings Russian Investors Limited, which in turn belonged to the Russian Investors Group Limited in the Bahamas. As of June 1998, the list of directors of Sequential Holdings Russian Investors included Vladimir Moiseev, an assistant to Mr. Khodorkovsky, and former director of Valmet, Felix Pole. Menatep Finance SA and Menatep SA were the previous shareholders of this company."

It turns out that even after his formal departure from the oil company, Golubovich continued implementing projects in the interests of Mikhail Khodorkovsky. When the latter was arrested, Golubovich went on the run, but later returned to Moscow after entering into a plea bargain. It appears that Yukos shareholders made a strategic decision to keep at least one of their ranks as a "secret agent" in Russia. To achieve this, they did not spare even the archive of documents that Golubovich handed over to the investigation.

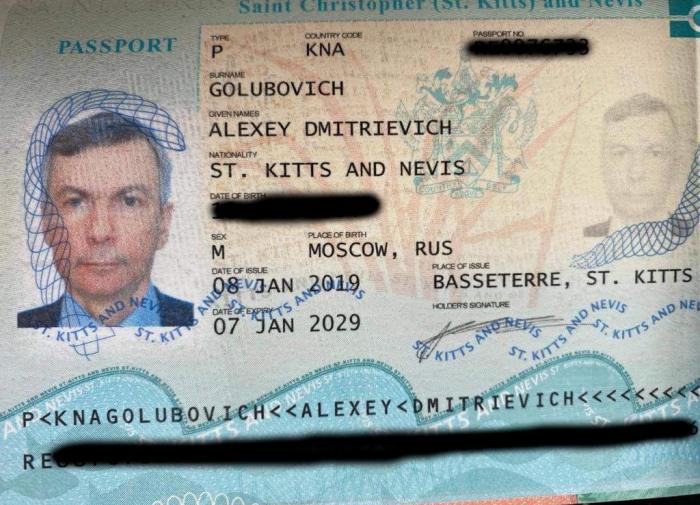

Other ex-shareholders received political asylum and passports in the UK and Israel, but Golubovich received neither. He eventually acquired the passport of the Caribbean islands of St. Kitts and Nevis. The passport could only be used as a "travel ticket". In 2006, the Izvestia newspaper published a series of articles dedicated to the reasons that led to Mikhail Khodorkovsky's imprisonment. A series of Golubovich's interviews during the same period were particularly interesting. In those interviews, he claimed that "no one has ever seen the shares with their own eyes, nor have I ever seen the Menatep shares that belonged to me."

As our investigation showed, not only did Golubovich see those shares with his own eyes, but he had been conducting transactions with them since 2003 when Lebedev and Khodorkovsky were arrested. The question is why Alexei Golubovich, the owner of 4.43% of Yukos, had to publicly lie about his ownership of the oil company's shares? The first thing that comes to mind is Golubovich's desire to deflect criminal liability from himself by pretending that he was not a real shareholder.

In fact, the reason is different: by 2006, the ex-shareholders had consolidated the company's shares and filed a lawsuit with the international arbitration in The Hague. It was highly important back then for Golubovich and his "colleagues" to hide Alexey's active participation in the process, because he had entered into a plea bargain in Russia. According to the documents at the disposal of the editorial office, Alexey Golubovich was (and, possibly, remains) a beneficiary of a litigation against Russia, in which, as is well-known, former shareholders of Yukos were awarded a record-breaking compensation of 50 billion dollars from the Russian Federation for violations of the Energy Charter that protects foreign investors (the litigation has not been completed yet). This, of course, does not disavow Alexey Golubovich's testimony in the Yukos case. It is worthy of note that Russian litigations have never been a priority for Khodorkovsky and his "colleagues"as they always looked towards the West.

Beneficiary of International Arbitration

When telling the story of Alexey Golubovich, one should pay attention to the case against his ex-wife Olga Mirimskaya, who became a direct participant in the events. Lenta.ru quotes a witness in the recent Mirimskaya case as saying:

“Golubovich, after the criminal prosecution of Khodorkovsky was initiated, refrained from any interaction with GML [Group MENATEP Ltd.]. He did not conduct any transactions with this company either. All issues related to the processing of transactions between Mirimskaya and Charles Russel and Rysaffe Charlotte N Isadora AS TR were entrusted to Andrey Lisyansky, a member of the Board of Directors of BKF Bank LLC."

The witness repeated exactly what Golubovich himself said publicly.

"Thus, it follows that Mirimskaya was actively cooperating with Khodorkovsky in 2006–2007 in order to conceal and legalize the property stolen from OAO NK Yukos, and derived illegal income in the proven amount of $135 million, which was not final, since Mirimskaya is claiming a part of $50 billion - the amount that the former shareholders of OAO NK Yukos won in a lawsuit against the Russian Federation," the witness told investigators of the Investigative Committee of the Russian Federation.

It appears that there is a serious mistake in this testimony: Mirimskaya's surname must be replaced with Golubovich, because it is he who could claim money from the Russian Federation in the GML lawsuit through his trust. Is it a careless investigation or a deliberate juggling? The case file in the Hague arbitration indicates the structure of the ownership of Yukos shares, and the name of Olga Mirimskaya does not appear there, but the name of Alexey Golubovich does, even though he allegedly "refrained from any interaction" with GML.

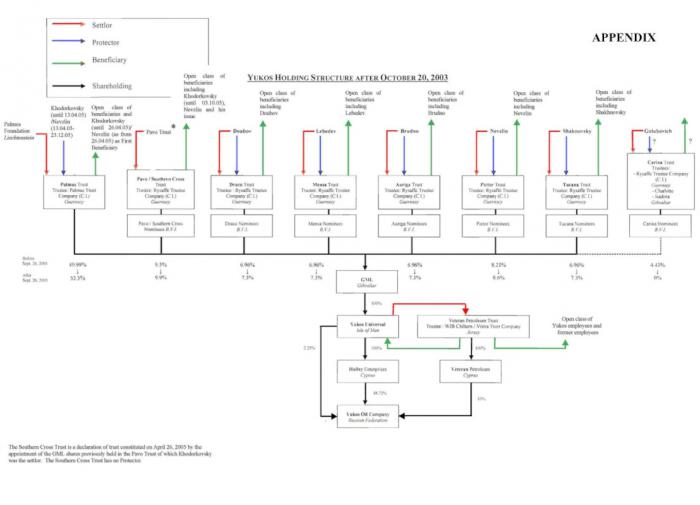

The arbitration documents establish that the shares of all companies that participated in the litigation to recover 50 billion from Russia were registered in trusts. The founders, beneficiaries and administrators of those trusts are listed in those documents too. Interestingly, it is one company that runs all the trusts without exception - Rysaffe Trustee Company. The shareholders of the oil company consolidated the assets before filing claims with the international arbitration against the Russian Federation. Alexey Golubovich was the last to "consolidate himself" - he owned 4.43% of the company's shares. Golubovich established the Carina Trust Limited in 2003, after legal proceedings were initiated against Yukos in Russia (remember, he claimed that he had no more business with the company?). Golubovich transferred 4.43% of his Yukos shares to this trust. On October 20, 2003, five days before the arrest of Khodorkovsky, but after the arrest of Platon Lebedev, Alexey Golubovich, on behalf of the Carina Trust Company, signed a discretionary management agreement with Rysaffe Trustee Company - Yukos was collecting all shares in one pool to facilitate the coordination of their international lawsuits.

The transfer to the discretionary management of fugitive shareholders of Yukos was carried out with an eye to future litigation. Indeed, Yukos shareholders filed documents with the international arbitration in The Hague in 2006, claiming that Russia had violated the Energy Charter. There was a certain sense in the consolidation of the assets - it was important for Yukos to demonstrate that all "foreign investors", including Golubovich (through a trust), were acting as a united front. Yet, there are questions to Carina Trust Company even in international arbitration. For example, it is not clear from the documents who acts as the beneficiary of the trust. Noteworthy, the law on trusts stipulates that the trustee should act in the interests of the beneficiaries of the trust. At the same time, it is not allowed to change the beneficiaries. Carina Trust Company has the founder and beneficiary - Aleksey Golubovich. For some reason, as follows from the correspondence, in December 2006, after the start of arbitration proceedings, Rysaffe Trustee Company did not provide GML lawyers from Shearman&Sterling with documents on the beneficiaries of Carina Trust Company: "In relation to the trust Carina Rysaffe Trustee Company (CI ) Limited is acting as a trustee together with two Gibraltar trust companies - Charlotte Limited and Isadora Limited - and they have now refused to authorize the disclosure of any trust documents, whether abbreviated or not."

The conclusion is self evident: The Yukos shareholders where hiding the founder of Carina Trust Alexey Golubovich. In 2006, there was a sharp moment of confrontation, and Golubovich, we recall, entered into a plea bargain in Russia. Apparently, the remaining shareholders had a reason not to ruin this deal. It is worthy of note that the structure of ownership of Yukos' shares clearly shows how $50 billion will be distributed if Russia admits the loss. The final recipients of the money are the beneficiaries of the trusts. Most likely, Alexey Golubovich is still among them. The statement from the Russin Federation from July 29, 2011 clearly indicated Golubovich as one of the "individual owners behind the plaintiff companies". Accordingly, he appears to be a beneficiary, if Russia recognizes the decision of the court in The Hague.

To summarize: as a result of manipulations with trusts, the interested parties obtained an opportunity to file a lawsuit against the Russian Federation with the international arbitration in The Hague demanding compensation for losses for the violation of the Energy Charter that protects investors from expropriation. According to the 2014 court ruling, the appeal of which is still pending, Russia is obliged to pay $50 billion to the offshore companies that are owned by the trusts of Yukos shareholders including as it turns out, Golubovich. This is a record-breaking amount in the history of the Hague arbitration.

Between two chairs

Noteworthy, Carina Trust Company is the youngest of the trust funds behind the lawsuit that was field at international arbitration against Russia. According to the documents - contracts and letters that the editorial office has at its disposal - Golubovich had been dealing personally with transactions related to Yukos shares for six years and interacting with fellow shareholders contrary to disseminated information and references to "witnesses".

For example, in his correspondence with Carina Trust managers in May 2005, Aleksey Golubovich discussed issues of an option for the shares of the oil company and requested commercial information:

"Ask GML to provide up-to-date audited financial statements of the companies, in which GML invests. Provide a copy of correspondence between GML and its auditors regarding the net worth of GML's investment in Yukos."

We would like to say it again here that Aleksey Golubovich declared that he had nothing to do with Yukos since the early 2000s. He continued to discuss financial and legal issues with his ex-colleagues even after Yukos (GML) filed a lawsuit against Russia at the Hague Court of Arbitration.

In addition, Alexey Golubovich received tens of millions of dollars from Yukos-associated companies. For example, the case file contains a letter that Golubovich wrote on January 29, 2004 (as the founder and beneficiary of Carina Trust) to the the Rysaffe Trustee Company with a request to transfer $44 million from the Carina Trust account to the account of Golubovich’s company Dicomax International. At the time of receipt, it is deemed the money that had been obtained as a result of criminal activities (according to the decision of the Russian court, Yukos money was obtained criminally). In 2021, these facts sparkled with new colors across several media channels. Olga Mirimskaya was unexpectedly called a shareholder of Yukos. All transactions related to Golubovich’s 4.43% of Yukos shares were attributed to her, which is of course absurd, because all transactions with shares bear Golubovich's signature. His signature is on trust management agreements with Rysaffe Trustee too. In all cases, GML structures appeared to be the other party in the deals with Golubovich.

The GML money would be sent to Dicomax in later periods too - in 2008, for example. This is evidenced by Golubovich's letter to Gibraltar-based companies Isodora Ltd. and Charlotte Ltd. In a letter from October 6, 2008, Golubovich, as the founder and beneficiary of Carina Trust Company, asked them to transfer money to the account of Dicomax International. How so?! After all, the "witness" in the Mirimskaya case claimed that both Olga Mirimskaya herself and Andrey Lisyansky from BKF Bank interacted with offshore companies, remember? We also recall here that by this time Golubovich had already concluded a deal with the Russian investigation into the Yukos case and gave his first testimony in Moscow, back in March 2008.

It seems that the managing director of Arbat Capital is a champion in sitting between two chairs. On the one hand, he helps Russia in the case against Yukos, but on the other hand, he receives tens of millions of dollars from Yukos on a regular basis. The main question is - for what? Why didn't investigators question Alexey Golubovich's words when he said that he had had nothing to do with Yukos since 2001? Why can the obviously biased testimonies from unnamed witnesses be taken into account, while the documents that Golubovich has at his disposal can be ignored? Even though it has been almost 20 years since the fall of Yukos, there are too many questions left in the case of the oil company and its shareholders. The answers to those questions will definitely strengthen the position of the Russian Federation at international courts.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!