Smart Investing In Oil

By Mark S. McGrew

Today’s oil price of $44.13 is giving economic experts a reason to make us think it’s the end of the World. Maybe it is for them. What do they know?

This past summer, oil was up to $147 and causing some serious problems for everybody except the oil companies and people who owned oil interests. They were all very happy.

But for the un-invested person, it was just a taste of what is to come in the near or distant future. The World learned that the price of oil can radically affect their lives and their businesses in a very short period of time. Businesses closed, government offices cut back, families suffered and people died.

There is no such thing as “The Law of Supply and Demand” in the oil business. This past summer we saw that prices went down when supplies dropped. We saw prices go up again as supplies increased. Theory after useless theory was spouted out by the Oil News Gurus and none of them had a clue as to what they were talking about. Instead of doing their homework and studying 100 year trends and studying the geo-politics of oil, they took the one minute shortcut: Find some news in the market that everyone has heard and blame the price on that, whether it goes up or down.

The are two things that we know for certain about oil: 1. The price does change. 2. It produces wealth.

The cost to find oil, bring it out of the ground and get it to the buyer is about $2.00 per barrel in Saudi Arabia and as much as $20 in Alaska. Saudi Arabia wants to see higher prices as do most producing nations. A return on their investment of 20 times is just not good enough for them? Of course not. Why settle for 20 times your money back when you can get 50 times or 100 times?

Especially if you can starve out some undesirable poor people in the process.

The small handful of people who control the oil and the prices can watch the news from around the World as people’s lives go into chaos, trying to survive, seeing millions of people trying to feed themselves, bankruptcies, war, nations in turmoil and looking out their government paid office windows at the little people in the streets scrambling to stay alive. Food riots, rampant crime waves, supplies of every product on Earth, including life saving medicines being cut back. Just the entertainment value alone is reason to hike the prices.

So why not join the party and be an acceptable member of that perverse elite group? With the money a person can make with oil, who knows, maybe some good can be done with it.

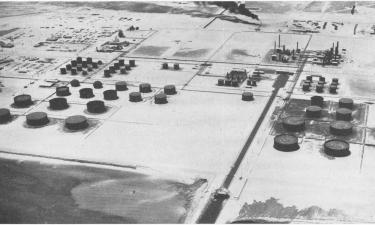

Investing in oil can be done in many ways. An individual can buy stock in a large or small company, invest directly with a driller, hoping to hit a big one or buy oil that has already been discovered and has wells producing every day and every night like clockwork.

The degree of risk varies on each method. Drilling Wildcats, new wells without any geological evaluations, just a hope and a dream may be a one in 35 chance of hitting the payzone. Buying stocks may give you a 3% to a 15% annual return or none at all if the company fails.

Investing directly into currently producing wells that will continue to produce income, regardless of whether the company survives or not has the lowest risk and sometimes, the lowest return on your investment.

85% of new wells in America are drilled by small companies and individuals. 62% of all the oil flowing out of the ground is oil that is owned by these smaller companies. This is where you will find bargains.

With low oil prices, as in any business, the owners need capital to expand and grow. Many are more than willing to sell the monthly income for one big check to cash out. Just as in buying any income producing property like apartments or houses, oil wells can be bought directly from the owner. The going price is ¼ to 1/3 of the posted price of oil. For example, if oil is selling at $100 a barrel, the owner will sell the oil that is still in the ground for $25 to $33 per barrel.

This past summer we saw purchases by large companies, buying oil in the ground, at those rates.

In June, when prices were high, Devon bought 50 million barrels for $40 a barrel. Looking back now, that was not such a good buy. But since then, they have bought in separate transactions from various companies, 30 million barrels for $12.50 a barrel, 88 million barrels for $13.64, and 78 million barrels for $14.58 a barrel. And a few other companies, Plains Exploration and Production bought 92 million barrels for $13.58, Cano Petroleum bought 3.1 million barrels for $13.16 and Gryphon Production bought 1.6 million barrels for $8.13.

These same formulas for purchase apply to any size project, large or small. To find the projects is like finding anything that you want to buy. Look in a directory. Go on the internet and search for “oil producers” “oil brokers” “oil properties” “oil Royalties for sale” “oil production for sale” “Oil and Gas Landmen”. Ask your broker where to find an oil property listing service

Just like Realtors, there are companies that list properties for sale. PLSX.com is a good company in Houston, Texas with new listings every week. EnergyNet.com is an online auction service of income producing properties. At EnergyNet there are properties to fit any budget and those properties average a payback in 40 to 60 months.

Oil properties will always have a geological report on current reserves in the ground and give you a good idea of what to expect as to how long you will receive income. If there are no reports and you have to take the sellers word for it, don’t buy it.

After you have made the purchase, your income checks will start coming to you within 30 days and every month thereafter. The length of time that oil wells produce can vary from just a few years to 80 years or more.

Your transaction will be filed and recorded in the local county courthouse and you will receive Title to it just as in buying any Real Estate. You will also receive a “Division Order”. This tells the Operator who to send checks to and for how much.

The “Operator” is just that. He is the one who handles all operations of your property such as maintenance, transporting the oil to the buyer, receiving those checks and disbursing the checks and sending tax forms to each of the recorded owners. Many times the Operator is a large company and some times it will be a major oil company like Exxon or Chevron.

It is important to know that you will own the oil and just like owning an apartment project, you are the one who can hire or fire the Operator. If you have partners on the oil property, you will all vote together if you need a new Operator.

As in all business transactions, remember Caveat Emptor, “Buyer Beware”. Don’t expect what you don’t inspect. Educate yourself. If you are not able to travel to inspect possible purchases, hire someone who will, preferably a Landman or someone who knows some Landmen. The Landman is the person who knows his way around the paperwork, how the county works and what a property is worth.

Good luck and due diligence are the keys to success in the oil business. Luck, though, is a small percentage of the equation if you take your due diligence seriously and use qualified people to find what you want. There are many properties with producing wells that will return your purchase price within three years or less. It is possible to find production that will pay you back within 12 months. This is at today’s price of around $50 a barrel. If oil goes up to $100 again, you would see your purchase money come back to you twice as fast as what is stated above.

Oil prices will always go up and down. The price changes will always affect your lifestyle. How that is affected is just a question of which side of the pump you are on.

When prices go down you will be watching the price chart every day, hoping for an increase. When prices go up and all of your friends are worried, you will be laughing, cheering for the prices to go higher. And if that happens to you, do something good with the money. Before you make your first purchase, run the numbers and see if you can’t set aside a small amount of what you’ll make to help some people who need the help. If you gain, you should share. In the oil business, that’s the way we do it.

Mark S. McGrew

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!