Oil prices reach 81 dollars per barrel

Oil prices have reached a new high of $81 per barrel amid hopes that the U.S. Federal Reserve will cut a key interest rate later Tuesday. This move would bolster the economy and strengthen petroleum demand in the world's largest energy consumer.

Investors expect the Fed to cut the benchmark federal funds rate at least to 5 percent - a quarter-point reduction - to ease pressure on the U.S. credit market.

"The market will be waiting to see how much the Fed cuts interest rates and whether its statement indicates that there may be further rate cuts or not, and those will affect perceptions of the U.S. economy and the demand for oil," said David Moore, commodity strategist with the Commonwealth Bank of Australia in Sydney.

"The background picture is one of tight oil markets. Data from the U.S. Energy Information Administration has shown declining oil inventories in recent weeks," Moore said. Oil inventories are falling in the U.S., but remain at record levels.

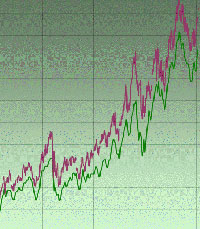

Light, sweet crude for October delivery rose as high as US$81.24 a barrel in Asian electronic trading on the New York Mercantile Exchange. It has since retreated slightly to US$81.14, still up 57 cents, mid-afternoon in Singapore.

The contract jumped as high as US$80.70 a barrel in intraday trading Monday before settling at a record close of US$80.57, up US$1.47.

"I don't know that there's any particular trigger for the rise in oil prices we saw last night," Moore said. "But once they started increasing, they did gather a bit of momentum of their own. I think that's why we ended up seeing oil prices rising as sharply as they did."

Oil prices have set several new records over US$80 a barrel in recent days for a number of reasons, including perceptions that problems in the U.S. subprime mortgage industry would have a minor effect on the economy. The nine-session rally reversed August's downward trend, which was based in part on concerns that subprime problems would spread, drag down the overall economy and curb demand for petroleum products.

Beyond the economic worries, energy futures have been buffeted by supply and demand considerations in recent weeks. Last week, gasoline and oil prices jumped after Hurricane Humberto cut power to Texas, temporarily shuttering several refineries.

Most of those facilities are now in the process of restarting. But the incident reminded investors of how quickly a hurricane can develop and disrupt energy supplies.

In London, October Brent crude rose 13 cents to US$77.11 a barrel on the ICE futures exchange.

Heating oil futures added 0.73 cent to US$2.236 a gallon (3.8 liters) while gasoline prices gained 0.6 cent to US$2.0502 a gallon. Natural gas futures dropped 4.8 cent to US$6.605 per 1,000 cubic feet.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!