Bush's mortgage plan not perfect, as he says

A White House’s plan to freeze their low introductory loan rates for five years will likely help only those of U.S. homeowners who face huge jumps in their mortgage payments.

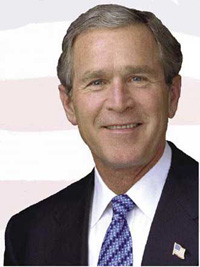

The plan, announced by President George W. Bush on Thursday, also does not force mortgage companies to give eligible homeowners a break. It is voluntary.

Meanwhile, there still is the possibility that investors who purchased the mortgages after they were bundled into securities - and who were counting on bigger returns from the higher rate resets - will balk at extending the duration of the lower rate.

Bush said 1.2 million people could be eligible for relief. Aid includes the rate freeze and helping people refinance into more affordable mortgages. The Center for Responsible Lending, a group that promotes homeownership and works to curb predatory lending, estimates that just 145,000 families will qualify for the rate freeze. The criteria are too strict, it says.

Even Bush acknowledged the plan is "no perfect solution." Treasury Secretary Henry Paulson said it was not a "silver bullet."

The rate hold goes to the heart of the relief effort for people with subprime mortgages, which are loans offered to borrowers with tarnished credit or low incomes.

The White House plan is aimed at stemming foreclosures, which have shot up to record highs as the housing market has gone from boom to bust.

Subprime borrowers have been hardest hit by the meltdown. Initially low interest rates that reset to much higher rates have clobbered those borrowers. Nearly 2 million adjustable-rate subprime mortgages will reset from introductory rates of around 7 percent to 8 percent to much higher rates this year and next. That raises the specter of even more people being forced out of their homes because they cannot keep up with their monthly payments.

Rising home foreclosures are a headache for politicians and a danger for the economy.

Bush tried to shift blame for the crisis to the Democratic-led Congress.

"The Congress has not sent me a single bill to help homeowners," Bush said.

One measure would give the Federal Housing Administration more flexibility; a second would change the tax laws temporarily to help people who have a portion of their mortgage forgiven by banks.

Senator Charles Schumer, a New York Democrat, complained the criteria for Bush's mortgage freeze are too narrow to help most distressed homeowners and worried that legal challenges by investors might stall the effort.

"While we certainly all hope this will be a shot in the arm for the housing slump, it is hardly a panacea," Schumer said. "There are too many families who may be left out, too much left up to the voluntary willingness of the private sector and too little disclosure and transparency to ensure families who do qualify are being helped."

Under the plan outlined Thursday, the rate freeze offer would be available only to people who have not missed any mortgage payments at their introductory interest rate. It also only would apply to loans taken out between 2005 and this past July 31 and scheduled to rise to higher rates in Jan. 1, 2008, and July 31, 2010. To make sure speculators don't get the break, the rate freeze offer applies only to people living in their homes.

The idea behind the administration-negotiated plan is that the five-year freeze will buy time for the housing sales and prices to start rising again. Such a rebound would enable homeowners to refinance their current adjustable rate mortgages into fixed-rate loans with more affordable monthly payments. But some people who want to buy homes and have been priced out of the market are upset that there's no help in sight for them.

Of the nearly 3 million subprime adjustable-rate loans surveyed by the Mortgage Bankers Association in the third quarter, a record 18.81 percent of them were past due. A record 4.72 percent of the loans entered into the foreclosure process during that period.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!