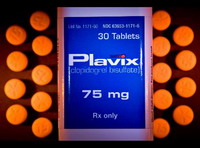

Blood thinner Plavix' s sales double Bristol-Myers Squibb Co's profit

Third-quarter profit of Bristol-Myers Squibb Co. more than doubled on a resurgence in sales of blood thinner Plavix, but job cuts are still possible this year amid a difficult drug approval environment.

The company also said that based on feedback from the Food and Drug Administration, it won't file a new drug application for its vinflunine drug as a treatment for bladder cancer.

Early Thursday, the company raised its outlook for adjusted 2007 earnings, after reporting that net income spiked to $858 million (599.62 million EUR), or 43 cents per share, from $338 million (236.21 million EUR), or 17 cents per share, a year ago. Excluding one-time items, the company earned 38 cents per share in the latest quarter.

Revenue rose 22 percent to $5.05 billion (3.53 billion EUR) from $4.15 billion (2.9 billion EUR), helped by a sharp increase in Plavix sales and the weaker dollar.

The results beat estimates of analysts polled by Thomson Financial, who expected profit of 37 cents per share on revenue of $5.02 billion (3.51 billion EUR).

But despite the better-than-expected results, Chief Executive James Cornelius told analysts in a conference call the company plans to continue its job cuts in the "coming weeks" and into 2008.

"We have begun a significant productivity initiative across all business units," said Cornelius. Earlier this year, the company announced plans for a cost-cutting program.

In a note to clients, Banc of America Securities analyst Chris Schott said he believes the restructuring plan is "the most significant potential near-term earnings driver." He noted the company had given prior guidance for cost cuts of $500 million (349.43 million EUR) by the end of this year.

Cornelius said sales of Plavix and other key products continue to grow, but with the rising impact of generic competition, the company will continue to identify opportunities to strengthen the front-end of its pipeline. He pointed to Bristol-Myers' recent purchase of Adnexus, which boosts its cancer drug offerings.

In the third quarter, Plavix sales doubled to $1.25 billion (0.87 billion EUR), helping to offset falling sales of cholesterol drug Pravachol and making up the bulk of the company's pharmaceutical revenue. Sales of Pravachol fell 55 percent during the quarter to $86 million (60.1 million EUR) because of generic competition.

Apotex launched a generic version of Plavix last August, but halted sales following a legal dispute with Bristol-Myers. This has given Plavix sales a much-needed boost, and unless Apotex wins its appeal of the U.S. District Court decision favoring Bristol-Myers, Plavix sales seem protected until patent expiration in 2011. In addition, a potential competitor in the anti-clot market, Eli Lilly & Co., suffered a setback Wednesday after the company suspended two mid-stage trials of its blood thinning drug candidate prasugrel, to investigate the possibility that doses may need to be altered.

Looking ahead, the company said a more challenging environment for drug approvals at the FDA could affect experimental drug saxagliptin. Bristol-Myers still continues to plan for the drug's FDA submission in the second half of 2008.

The company will take a fourth-quarter charge to account for the buyout of Adnexus, driving 2007 earnings to a range of $1.28 (.89 EUR) to $1.33 (.93 EUR) per share. Excluding one-time items, Bristol-Myers lifted its profit projections to a range of $1.42 (.99 EUR) to $1.47 (1.03 EUR) per share from $1.35 (.94 EUR) to $1.45 (1.01 EUR) previously.

Analysts are expecting profit of $1.44 (1.01 EUR) per share for the full year.

Bristol-Myers reaffirmed 2008 profit guidance of between $1.60 (1.12 EUR) and $1.70 (1.19 EUR) per share, excluding restructuring and other charges. Wall Street has forecast 2008 earnings of $1.70 (1.19 EUR) per share.

Shares rose 82 cents, or 3 percent, to $29.26 in midday trading.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!