Wrigley moves into chocolate market with $300M purchase of Russia's Korkunov

Gum and candy maker Wm. Wrigley Jr. Co. said Tuesday it is moving into chocolate, announcing the acquisition of an 80 percent stake in Russian premium-chocolate company A. Korkunov for $300 million (Ђ230 million).

The deal comes more than four years after Wrigley attempted to enter the chocolate market and failed with the rejection of its $12.5 billion (Ђ9.59 billion) bid to buy Hershey Co., the maker of Hershey chocolate bars, Hershey's Kisses and Reese's peanut butter cups.

"We have always said we would enter the chocolate segment of the total confectionery business if the right opportunity to create value for the Wrigley Company became available and this acquisition presents such an opportunity," said Bill Wrigley, Jr., the company's executive chairman.

Korkunov is about one-fiftieth the size of Hershey with an estimated $100 million (Ђ76.7 million) in 2006 sales.

Analysts predicted more acquisitions, some likely also involving chocolate.

"That's one of the ways Wrigley can leverage its vast worldwide distribution network," said Mitchell Corwin of Morningstar Inc. "Right now it mostly distributes chewing gum. But if it can offer more products to the same retail points of sale, there would be benefits to that longer-term."

Prudential Equity analyst John McMillin said the acquisition appears to have been orchestrated by Bill Wrigley rather than new Chief Executive Bill Perez, the ex-Nike Inc. CEO who joined the company in October.

McMillin also applauded the deal.

"Frankly we like an aggressive management team and we have grown tired of just hearing about how Cadbury is expanding into gum," he said in a note to investors.

A. Korkunov was founded in 1999 by Russian entrepreneurs Andrey Korkunov and Sergey Lyapuntsov. It is the seventh largest Russian chocolate maker and No. 2 in the premium-boxed category, according to Wrigley.

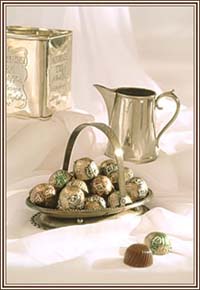

It markets products across Russia and makes boxed, bars and loose chocolates at a production facility just outside Moscow.

"The addition of this premium brand business builds upon our existing strength in Russia," said Perez. He said Wrigley's existing business model, distribution and local staff in the country leave it well-positioned to create new growth opportunities for the A. Korkunov products.

Wrigley said it will fund the purchase with available cash and a "modest" amount of debt and purchase the remaining 20 percent interest in Korkunov over time.

The payment will be partially offset by about $55 million (Ђ42.18 million) in tax benefits, reports AP.

The acquisition is subject to customary closing conditions, including certain regulatory clearances.

Shares in Wrigley rose 35 cents to close at $50.85 on the New York Stock Exchange.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!