Jobless Claims Fall More Than Expected

The Labor Department reported Thursday, the number of initial claims for state unemployment benefits fell by 12,000 to a seasonally adjusted 502,000 in the week ended Nov. 7.

That's the fewest initial claims since early January. Initial jobless claims have hovered above 500,000 for 52 straight weeks, as the unemployment rate has climbed to a 26-year high of 10.2%.

Economists surveyed by MarketWatch expected initial claims to drop to about 510,000. The level of initial claims in the week ended Oct. 31 was revised up by 2,000 to 514,000. See Economic Calendar.

The four-week average of initial claims dropped 4,500 to 519,750, the lowest since November 2008. The four-week average smoothes out quirks due to one-time events such as bad weather, holidays or strikes, MarketWatch reports.

It was also reported, total claims lasting more than one week, meanwhile, also declined.

The four-week moving average of new claims, which aims to smooth volatility in the data, fell by 4,500 to 519,750 from the previous week's revised average of 524,250. That is the lowest level since Nov 2008.

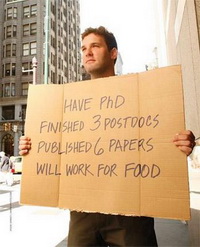

Initial claims still remain at a fairly high level, suggesting the job market has some way to go before it recovers. But some economists see positive signs in the recent decreases in the four-week-moving average, and Thursday's larger than expected decrease in initial claims also may suggest an improvement in labor conditions.

Still, data last week showed that the U.S. unemployment rate rose to its highest level in 26 years in October as employers cut more jobs than forecast. The jobless rate rose to 10.2% last month from 9.8% in September as nonfarm payrolls fell by 190,000, The Wall Street Journal reports.

Meanwhile, the price on 30-year Treasury bonds, the longest U.S. government debt maturity, last traded up 3/32, little changed from the level prior to the jobless data.

Their yield which moves inversely to their price was 4.41 percent, unchanged from the level before the data and late Tuesday.

The U.S. bond market was closed on Wednesday for Veterans Day, Reuters reports.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!