CarMax: Trend To Surge

Car dealership chain CarMax Inc. reports its fiscal 2d quarter profit grew on higher sales and a one-time gain related to its auto financing business.

The results topped Wall Street estimates, and its shares rose more than 6 % in premarket trading.

The Richmond, Va.-based company that predominantly sells used vehicles said it earned $103 million, or 46 cents per share, for the three months ended Aug. 31, compared with $14 million, or 6 cents per share, a year ago.

The results included a net gain of 10 cents per share related to its financing division.

Sales increased 13 % to $2.08 billion from $1.84 billion in the same period last year. Sales at stores open at least a year rose 8 % during the quarter.

Its shares rose $1.17, or 6.1 %, to $20.50 in premarket trading.

"We are extremely pleased to report a record level of quarterly income, despite the continued challenging economic environment," CEO Tom Folliard said in a news release.

While used cars didn't qualify under the federal Cash for Clunkers program that gave rebates for junking older cars in place of more fuel-efficient vehicles, Folliard said the summer program resulted in a spike in traffic in late July and August. Historically, previous incentives have had a positive impact on sales.

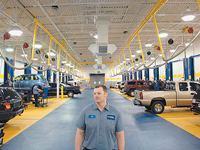

Folliard said the company, which operates 100 stores, is encouraged by its strong sales execution, solid gross profit and improved income from its financing arm. He also said while Clunkers program had a positive effect, it was "only one of many elements that drove our success."

Used vehicle sales rose 9.6 %, while new vehicle sales fell 18.5 %, the company said. The average selling price of its used vehicles increased 5.6 %, while gross profit per vehicle increased 13.4 % to $2,120.

The company's auto financing arm reported income of $72.1 million compared with a loss of $7.1 million in the year-ago period, due in part to an increase in the value of bonds the company holds. In the year-ago period, CarMax saw adjustments related to loans that originated in prior fiscal years, mainly projected losses on defaulted loans.

Expenses for the second quarter dropped 3.1 % to $218.1 compared with the year-ago period due to lower advertising spending and efforts to curb store and corporate overhead costs, the company said, The Associated Press reported.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!