US economy grows 4.9 percent in summer, but it won't continue

The U.S. economy grew 4.9 percent this summer – in the strongest performance in four years – but the process is not expected to last through the current quarter amid the continuing housing slump and credit crunch.

The Commerce Department's new reading of the gross domestic product from July through September, released Thursday, was even better than the government's initial estimate of a brisk 3.9 percent growth rate for period. Stronger U.S. exports to overseas buyers and more inventory investment by businesses were the main reasons for the improvement.

The big pickup in GDP, though, did not change the picture forming in the current October-to-December quarter. And that scenario is somewhat grim, with indications the economy will lose considerable steam. Growth is expected to slow to a pace of just 1.5 percent or less in the final three months of this year.

GDP is the value of all goods and services produced within the United States and is the best measure of the country's economic health.

The upgraded GDP figure for the third quarter matched economists' forecasts. The strong showing suggested that the economy was resilient even as the housing market plunged deeper into turmoil and credit problems intensified. Federal Reserve officials and other economists - looking at fresher barometers of economic activity - have warned that the economy is in for a rough patch.

There have been mounting signs in recent weeks that the housing and credit problems are affecting the behavior of consumers and businesses alike.

Spending by consumers and businesses is the lifeblood of the country's economic activity. The big worry for economists is that consumers and businesses will cut back on spending and investing, dealing a blow to economic growth. The odds of a recession have grown this year. Still, Fed officials and many other economists remain hopeful the country will weather the financial storm without falling into recession.

The Fed has sliced interest rates twice this year - in September and late October - to keep the housing collapse and credit crunch from throwing the economy into a recession. Fed policymakers at the October meeting signaled that further rate reductions may not be needed. Since then, however, financial markets have suffered through another period of turmoil. The housing slump has deepened, consumer confidence has sunk and shoppers are flashing signals of caution.

Against that backdrop, investors and some economists believe the Fed might lower rates when they met on Dec. 11.

Even with the remarkable GDP showing in the third quarter, the housing situation grew more bleak.

Builders slashed investment in housing projects by 19.7 percent, on an annualized basis. It marked the biggest cut in a year. Credit problems have made it harder for would-be home buyers to finance a home, deepening the housing slump. The inventory of unsold homes continues to pile up and builders continue to cut back. The industry's problems are expected to drag on well into next year, acting as a weight on national economic activity.

Businesses largely carried the economy in the third quarter. Sales of U.S. exports abroad powered growth. Those sales were aided by the falling value of the U.S. dollar, which make U.S. goods cheaper to buy on foreign markets. Exports grew by 18.9 percent, on an annualized basis, in the third quarter. That was the biggest increase in four years.

Inventory investment by businesses also added to GDP growth as did spending on equipment and software and construction of new plants, office buildings and other commercial construction.

The huge losses reported by financial companies due to the mortgage meltdown took their toll on corporate profits. One measure showed that after-tax profits were flat in the third quarter after rising by 5.2 percent in the second quarter.

Consumers were somewhat subdued in the third quarter. Their spending grew at a 2.7 percent pace, up from a weak 1.4 percent growth rate in the second quarter but still considered somewhat lukewarm. Analysts expect consumers turned cautious in the current October-to-December period, a factor in forecasts of slower overall economic growth. Post-Thanksgiving retail sales were promising, however.

A separate GDP-related gauge of inflation showed that "core" prices - excluding food and energy - rose at a rate of 1.8 percent. That was the same as previously estimated but up from a 1.4 percent rate in second quarter. Still the inflation figure was within the Fed's comfort zone.

Oil prices, which have been marching higher, have eased in recent days and are now hovering at above $90 a barrel. High energy prices can crimp spending by people and businesses on other things, putting another damper on economic growth. So far more expensive energy hasn't forced a widespread boost in the prices of lots of goods and services, which would spread inflation through the economy. But Fed officials - ever vigilant against inflation dangers - have said they'll keep a watchful eye on the situation.

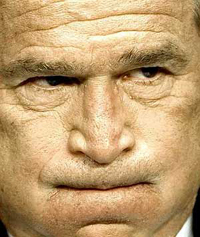

The fallout in the housing and credit markets are weighing on President George W. Bush.

The public is giving Bush low marks for his handling of the economy. Just 32 percent - a record low- approve of his economic stewardship, according to a recent AP-Ipsos poll.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!