Oil prices have no further climb after report about oil inventories

Oil prices fixed their positions in climb to $100 a barrel Wednesday after oil inventories fell less than expected last week while refinery utilization remained flat.

Oil investors largely viewed the report as neutral in that it confirmed a view that oil supplies are falling, but offered no real surprises. A larger than expected drop would have likely propelled oil past $100 a barrel for the first time.

Crude inventories did fall at the closely-watched New York Mercantile Exchange delivery terminal in Cushing, Oklahoma, but that did not appear to be enough to propel prices sharply higher.

"We got kind of a mixed reaction," said Phil Flynn, an analyst at Alaron Trading Corp. in Chicago.

Some analysts think oil prices have far outpaced levels that are justified by the underlying principles of supply and demand. These analysts blame market speculators for pushing crude prices to record levels, and predict that a correction, or sharp decline, is imminent.

"At some point, the market does actually discount the bullish possibilities," said Tim Evans, an analyst at Citigroup Inc., in New York. "That risk of exhaustion is very present here."

A separate report Wednesday by the International Energy Agency warning of an oil supply crunch by 2015 was not enough to send prices higher. The IEA concluded that growing demand for energy in China and India will boost the world's oil needs by more than 50 percent by 2030.

Light, sweet crude for December delivery fell $1.69 to $95.01 a barrel on the Nymex. Before the report's release, prices rose as high as $98.62, a new record.

December gasoline futures fell 3 cents to $2.405 a gallon on the Nymex, and December heating oil futures fell 2.2 cents to $2.5858 a gallon. December natural gas futures fell 25.6 cents to $7.607 per 1,000 cubic feet on expectations that inventories rose last week and on forecasts for warmer weather in the Midwest and Northeast.

In London, December Brent crude fell $1.10 cents to $92.16 a barrel.

The EIA reported Wednesday that crude supplies fell by 800,000 barrels during the week ended Nov. 2, half the 1.6 million barrel decline analysts surveyed by Dow Jones Newswires, on average, had expected.

Supplies at the Nymex delivery terminal in Cushing, Oklahoma, fell by 1.7 million barrels last week.

Refinery utilization remained flat at 86.2 percent of capacity. Analysts had expected an increase of 0.8 percentage point.

Gasoline inventories fell by 800,000 barrels last week, countering analyst expectations for an increase of 200,000 barrels. Inventories of distillates, which include heating oil and diesel fuel, rose by 100,000 barrels last week. Analysts expected a decline of 500,000 barrels.

Imports of crude oil rose by an average of 275,000 barrels a day last week to 9.7 million barrels a day. Gasoline imports rose by 107,000 barrels last week to an average of 1.1 million barrels a day.

Demand for gasoline rose slightly last week, by about 12,000 barrels, the EIA said. Over the last four weeks, demand is up about 0.8 percent over the same period last year.

However, both Flynn and Evans questioned the EIA demand figures, noting they are often revised downward after the fact. If oil and gas prices continue to rise, demand will come down, analysts say.

"I would be surprised if we didn't see some kind of demand slowdown after a price increase of this level," Flynn said. "I'm not sure that we've seen the impact of this price spike yet on demand."

Oil prices are up 42 percent since August.

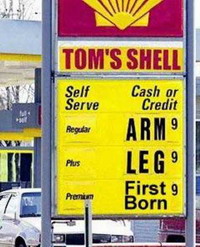

Oil's seemingly relentless climb does raise the question of how high energy prices will go. If crude does keep going up, it might be some time until consumers see relief at the pump. Some analysts predict gasoline prices could rise as high as $3.50 to $4 a gallon (92 cents to $1.05 a liter) in the U.S. next summer.

Meanwhile, estimates of where oil is headed from here range from $50 a barrel to $120. Flynn, who long ago predicted prices would rise to near $100 this year, now says he is beginning to doubt whether prices will actually reach $100 a barrel during the current price spike.

"I think the market is due for a correction," Flynn said.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!