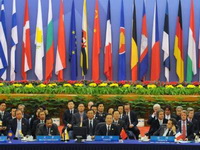

G20 to Become Premier Coordinating Body in Global Economic Order

According to a draft communique, the G20 is set to become the premier coordinating body on global economic issues. This is supposed to reflect a new world economic order in which emerging market countries like China are much more relevant.

Leaders of the G20 developed and developing nations also agreed to make the International Monetary Fund more representative by increasing the voting power of countries that have long been under-represented in the world financial body, said the draft G20 communique obtained by Reuters.

It called for a shift in IMF voting by at least 5 percent, although several G20 representatives said it was a 5 percentage point shift from developed to under-represented countries. Currently, the split in voting power is 57 percent for industrialized countries and 43 percent for developing countries. The shift would make the split nearly 50-50, Reuters reports.

The Los Angeles Times' Don Lee and Jim Tankersley write,: "The change reflects the world's shifting economic powers and a need for the U.S. and the traditional European powers to secure the cooperation of fast-growing economies such as China, India and Brazil to make progress on pressing issues.

"The G-8 -- made up of the U.S., Japan, Germany, Britain, France, Italy, Canada and Russia -- has been criticized as an elite, anachronistic body that couldn't get much done because the main issues they faced often involved emerging nations that weren't at the table

"The U.S. also is pushing in Pittsburgh to give greater representation to those emerging countries at the International Monetary Fund and the World Bank.

"The moves are part of an Obama administration effort to win the broad support here for a U.S. proposal calling for major economic structural changes designed to cure global imbalances," CBS News reports.

In the meantime, officials at the Group of 20 summit say leaders are working out the final details of a deal to limit risk-taking by large banks and control pay for their executives.

Some economists and officials blame banks for plunging the global economy into a deep recession, while some countries, including France and Germany, have expressed outrage at the large bonuses paid to the top executives at failed financial firms.

G20 officials say the deal will require banks to hold more cash in reserve in case their investments go bad. It will also require that salaries for top executives be tied to the bank's performance while allowing some pay to be confiscated if banks lose money.

The officials say the final agreement will not impose a hard cap on executive compensation. U.S. officials have said such a requirement would be a deal-breaker, Voice of America reports.

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!