Federal Reserve to decide about interest rates

Federal Reserve will discuss interest rates this week.

Investors can call it what they like - their Super Bowl, their Election Day, their Day of Reckoning - but they might want to keep in mind that Tuesday's decision may end up raising as many questions as it answers.

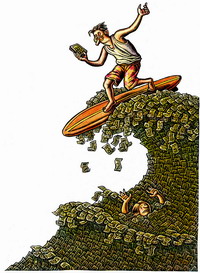

The stock market plunged from record highs this summer on fears about souring home loans and excessive leveraged debt strangling corporate and economic growth. Since then, the big question on Wall Street has been: Will the Fed finally lower interest rates? Tuesday afternoon, investors will find out.

No matter what the outcome, the stock market could be in for a wild ride.

Like many investment strategists, Bob Doll of BlackRock Inc. believes Fed policy makers will lower rates by a quarter of a percentage point Tuesday and alter their assessment of the economy - particularly given a decline of 4,000 jobs in August and weakening retail sales. But, he added, even if market gets its rate cut, the next day the market will probably ask: Now what?

"I'm not even sure good news from the Fed means we're out of the woods in terms of volatility," Doll said.

With all of the recent weak economic data, many investors have been crossing their fingers for a half-point rate cut, a move Swiss Re chief U.S. economist Kurt Karl said policy makers are probably loathe to make. "I don't think they want to give the market everything it wants. It's a very difficult situation."

Moreover, some experts argue the Fed may not go through with a rate cut at all, because the central bank, which hasn't reduced the benchmark fed funds rate since 2003, wants to avoid being viewed as bailing out investors. Plus, the dollar has fallen to an all-time low versus the 13-nation euro, the price of crude oil is in record terrain, and the Dow Jones industrial average is only 4 percent below the all-time high of 14,000.41 it reached in July.

Last week the major stock indexes fared well; a good deal of the gains came from high expectations of a rate cut, but some were also due to positive corporate news and an apparent return to normalcy in the market for commercial paper - bonds that companies sell for quick cash. The Dow ended up 2.51 percent, the Standard & Poor's 500 index rose 2.11 percent, and the Nasdaq composite index rose 1.42 percent.

Ultimately, the Fed's two main concerns are core inflation - which strips out food and energy prices, and has been easing recently - and the economy, which is at a greater risk of dipping into recession if the Fed doesn't make a rate cut, Karl said.

"Is it a bailout, or a protection of the economy? You can interpret it both ways," he said.

Karl said it's not the Fed's job to worry about the dollar, except for how it may affect the economy.

A weak dollar makes imported goods more costly for Americans and discourages foreign investors from buying dollar-denominated assets like U.S. Treasury bonds. But it boosts exports and benefits companies who pull in a chunk of their revenue from overseas.

Another reason the Fed's rate decision Tuesday might not totally placate investors is that there's a flood of important data pouring in this week with the potential to stir up more jitters about the economy and future Fed policy: notably, August prices for producers and consumers, August housing starts, and weekly jobless claims. Most economists anticipate very little change in core prices, ongoing sluggishness in housing and an uptick in jobless claims.

Also, the major investment banks - Bear Stearns, Lehman Brothers, Morgan Stanley and Goldman Sachs - release their third-quarter earnings this week. Wall Street will be poring over the reports to see if the banks' balance sheets held up during August's credit squeeze and stock market plunge.

And furthermore, even if the Fed does exactly what the majority of investors want, predicting its next move will continue to be Wall Street's favorite game. According to BlackRock's Doll, "A preoccupation with what the Fed is up to is here to stay for some time."

Subscribe to Pravda.Ru Telegram channel, Facebook, RSS!